How to create a home budget and get your debts under control.

Using the tips and tools I will present here, you can setup a budget that will get your spending under control and finally be able to get your debts under control and paid as quickly as possible.

I don't want to waste anyone's time so I'll get right to the steps:

- Step one is to get a handle on how and on what you're spending your money.

- Hard Way: Try to remember what you spent each day, or remember to collect receipts for everything, and then enter the amounts into a spreadsheet you create yourself either in your computer or on paper.

- Easy Way: For one month, and afterwards if possible, use only a debit card to pay for things you would normally have used cash for. To pay for bills, set up what is probably a free service from your bank to use their online bill payment service. This will also give you more control over when someone gets your money and also let you know exactly how much money you have available to you on any given day.

- Unless you know how to setup a budget spreadsheet, use the free online website, www.mint.com. Once you enter your information to allow the site to access your bank account, mortgage account, and credit card accounts, you will be able to see how you're spending your money. If you take the time to categorize each payment to its appropriate type of bill, you will know exactly what you're spending your money on and can even see it in a nice pie graph. Don't worry about security either, they are as secure as your bank in terms of safeguarding your login information and other confidential information. If you don't trust anything online you will have to go the spreadsheet way.

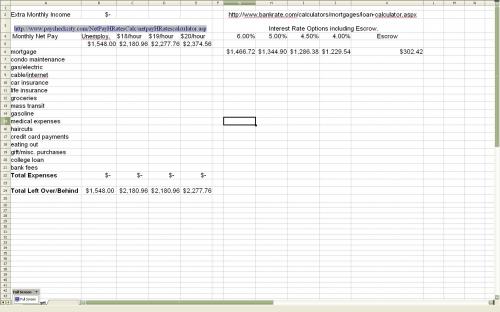

- If you go the spreadsheet way, you can find templates online and you can get a free spreadsheet program, and full office suite for that matter, from: www.openoffice.org. If you write to me at mail@wheatleyservices.com, I can send you a spreadsheet template with explanations of how to customize it to fit your budget. Put "Budget Spreadsheet" in the subject line. See example below:

- Once you know what you're spending your money on, you can figure out what to eliminate. I'm sorry folks but that's the only way to handle a debt problem. Debts come about because we spend beyond our means, so if we get a handle on our spending we can control our debts.

- Eliminate or decrease your spending on all non-essentials like eating out, buying coffee and snacks, impulse clothing and other item purchases, etc. You get the picture.

- After eliminating all non-essential spending, figure out using my spreadsheet or other means, how much is left over after all monthly bills are paid.

- Make a list of all of your non-mortgage debts. You will begin to pay the minimum on all of these debts except for the lowest amount. You will put as much of your left over money into paying off the lowest debt as quickly as possible. As each lowest debt is paid off, the money you put into that bill as well as what you were paying on the next highest debt will go towards paying off that debt and so on up the line until you're putting the most money as possible into paying off your final debt.

- By the way, all of the get out debt programs use this system, although some advocate paying off your biggest debt first. I believe that paying off your smallest debt first works faster and gives you a sense of accomplishment as you see one debt after another disappear relatively quickly as opposed to waiting seemingly forever for your highest debt to be paid off.

- To speed up the process, and in case you don't have money left over after paying off essential bills, you should figure out how to earn an extra monthly income. Whether you rent out a room/garage, sell possessions you don't use anymore, get a second/third job, sell products you make yourself, etc., getting extra money into your payment plan will ease the monthly burden tremendously.

- Once all your debts are paid off, you can use that extra money how you feel is best. You should use as much of that money for investments and savings, but you can also spend a little on "toys". After all one must enjoy life.

That's it. Once you get in the habit of following your monthly spending, keeping to essential spending as much as possible, sticking to your monthly budget, and hopefully putting some extra money in your pocket each month, you will be on the road to a debt-free life.

What did you think of this tutorial?

0 CommentsAdd a Comment